Accelerating DORA Compliance with Contract AI (Part 1)

How Financial Services Firms Can Use the Power of AI to Streamline DORA Compliance

This is part 1 of a two-part blog series exploring how contract AI can be leveraged to streamline compliance with the European Union's Digital Operational Resilience Act (DORA).

Understanding DORA's Requirements for Contracts

As the January 17, 2025 deadline for compliance with the European Union's Digital Operational Resilience Act (DORA) approaches, financial services firms are facing pressing challenges in executing their plans to achieve compliance.

DORA establishes a comprehensive regulatory framework to enhance digital resilience, ensuring financial institutions can withstand, recover, and adapt to operational disruptions and cyber threats.

It impacts a wide range of global financial entities that operate in European markets, including banks, insurers, investment firms, payment service providers, and crypto-asset service providers. By introducing standardized requirements, this transformative regulation aims to mitigate risk and address key vulnerabilities created by an increasing dependence on digital technologies.

DORA requires financial services entities to:

- include certain prescribed provisions in contracts with information and communications technology (ICT) service providers (with more onerous requirements for ICT services that support critical or important functions)

- maintain a register of information in relation to these contractual arrangements and need to be able to provide all or part of this information to regulators upon request.

- report at least annually on the number of new arrangements on the use of ICT services, the categories of ICT third-party service providers, the type of contractual arrangements and the ICT services and functions which are being provided.

To comply with DORA’s comprehensive contractual requirements financial services firms will have to:

- identify all contracts with ICT service providers and determine which of these are for services that support critical or important functions.

- review the provisions of contracts with ICT service providers, conduct gap analysis versus what is required by DORA and action the gaps by amending contracts with ICT service providers which are deficient.

- set up a repository for the relevant contract data that efficiently can be queried to provide information (i) in response to regulators upon request, and (ii) to satisfy the annual reporting on new arrangements.

Taking these steps can be an expensive, labor-intensive, error-prone process, especially for firms managing large volumes of ICT contracts.

How Catylex Simplifies DORA Compliance

Catylex leverages advanced AI technology to accelerate your DORA compliance process:

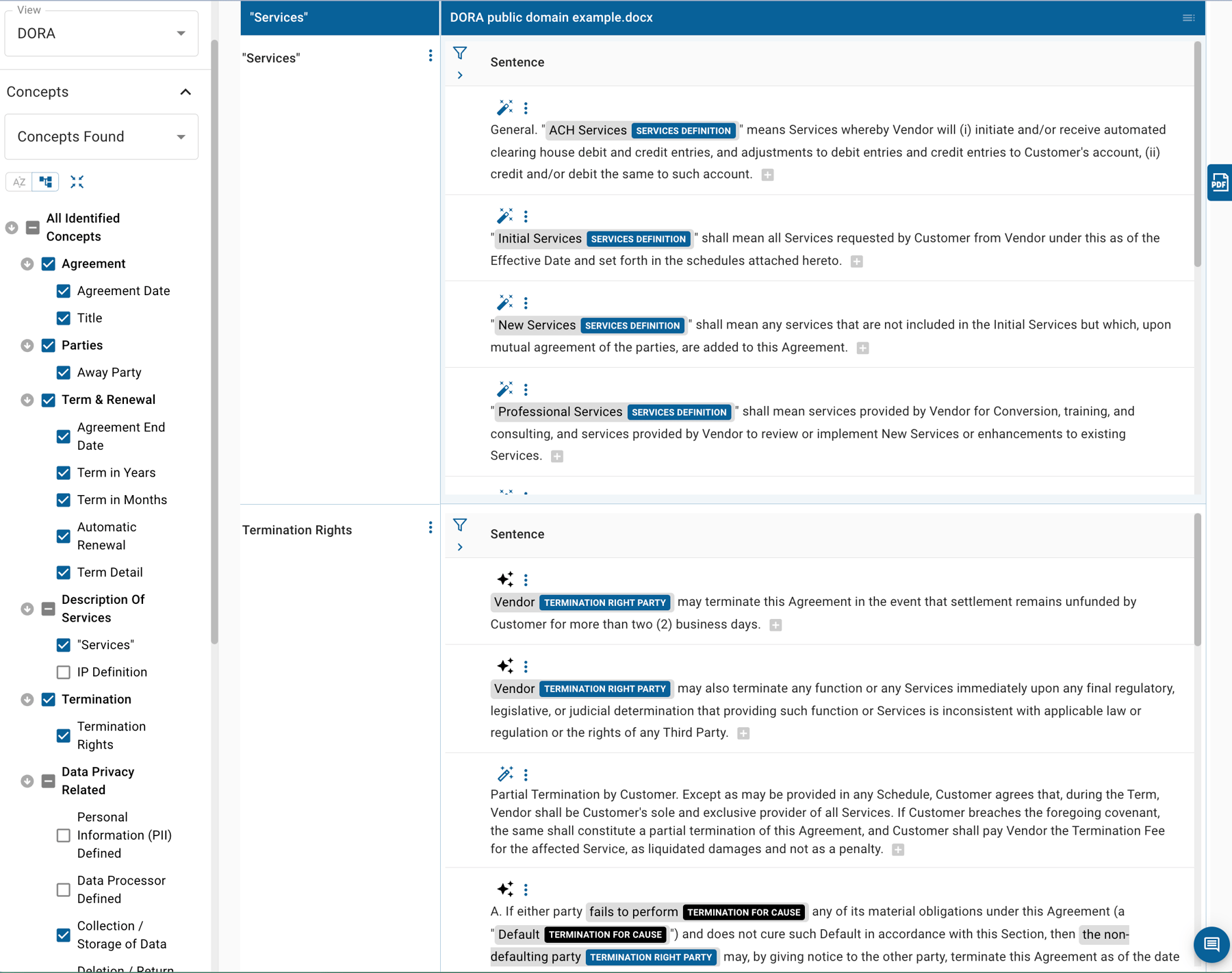

- Automated analysis of all your contracts so you can determine which contracts relate to information and communications technology (ICT) with 3rd party service providers. Catylex is scalable and can process and handle vast contract portfolios quickly and effortlessly.

- Automated identification of DORA-required provisions across your contracts and highlighting the gaps in these provisions. This puts financial services firms in a position to know what contracts and provisions they need to amend so they can action accordingly.

- Catylex is a contract data repository which allows users to easily access, query and export data for audits, reporting, and internal reviews and to meet regulatory reporting requirements under DORA.

For more information on how Catylex can help you comply with DORA please contact us.